Horizon Finance Group Adelaide

Table of ContentsHorizon Finance GroupHorizon Finance Group Adelaide

sector organizations. Yet unwind. It is not as difficult as it appears. If you are checking into a profession as a finance broker, here is what you need to know. Financing brokers also have close connections to constructing societies, financial institutions, and other borrowing organizations as well as can link with them to discover you the ideal feasible bargain. Horizon Finance Group Personal Loans. Finance brokers also have specialties, such as trading supplies and also various other assets like minerals and also metals. These sorts of financing brokers do the job to work out the finest rates for you. Finance brokers manage several economic items, such as insurance and also home mortgages, supplies and also auto and also individual car loans. Considering that these are their areas of competence, financial brokers typically have.

slight variants in their jobs from everyday, though generally, numerous have comparable duties. The more typical duties of monetary brokers consist of, yet are not restricted to: attracting clients though advertising and marketing and also networking; conference customers to discuss their economic items or financial investment demands; preparing records on clients'economic scenarios and also advising means to boost or keep their status; advising and sustaining clients with economic decision-making through life modifications like marriage, separation, or retired life; utilizing software program, files, or various other tools to comb through numerous items to match with their clients 'demands; speaking with banks or insurance providers regarding their clients 'needs as well as finalizing the most effective strategy for all events; arranging the documentation as well as speaking with the appropriate lawful entities until the lending or policy is enacted; and also making certain that all insurance coverages, fundings, and agreements comply with current government and state regulations as well as laws. If you desire to come to be a finance broker, you will certainly need to obtain a tertiary certification. You can start this procedure by completing Year 12 researches either through participating in high school or finishing an equal program at a various academic institution. You might likewise think about finishing a tertiary prep work certification if you want to transform occupations as well as have actually not taken component in official education and learning in a number of years. This action is optional in your quest to become a financing broker. Prominent associations in Australia include the Financial Solutions Institute of Australasia, the Home Mortgage and also Financing Association of Australia, and Money Brokers Organization of. Truck Finance Broker.

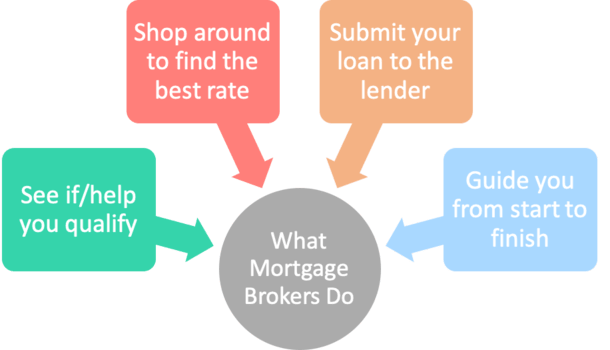

can compare the products available to provide a selection that really matches the requirements of their client; they basically simplify the residence financing procedure, a complex as well as frequently alien procedure, for their customer. They are able to complete much of the documentation, functioning very closely with their customers to collate the needed sustaining documentation, send the application to the proper loan provider, as well as handle the process through to negotiation. Q. With the majority of possible homebuyers incorrectly thinking brokers bill a cost for solution, exactly how are brokers in fact paid? A. Payments and also costs differ from lender to lender. If you are worried about the payments your broker may be earning, inquire ahead of time they are required to divulge any type of commissions they may be gaining to stay clear of any kind of conflict of interest. Q. Just how do possible property buyers locate a broker? A. There are several ways to discover a broker.

Personal Loans

Conversely, you can meet a couple of brokers as well as select the one that ideal suits you. The broker you pick must be a member of an industry body such as the FBAA. They need to likewise be approved under the National Customer Credit Protection Act and also have a Certificate IV, preferably a Diploma in Financial Provider Home Loan Broking. The current research study suggests 43%of possible property buyers are searching talking to even more than one broker during the home mortgage process. Why do you assume this may be the case? A. Consumers are trying to find a broker that provides excellent customised service as well as delivers on their pledges. They require to be able to feel they can rely on the person who is going to assist them with the most significant economic commitment

broker agent company. They will certainly function as a middle male in between those seeking a car loan as well as the financing service providers. They'll accumulate details on your service and with your approval use to small company loan suppliers in your place - Equipment finance. Most significantly an excellent broker will certainly talk with a much larger number of loan companies than maybe you would certainly do directly and save organization proprietors priceless time in putting on several finance suppliers themselves. If you are eager to use a financial institution as opposed to the lots of professional funding carriers that are currently discovered in Australia, then good brokers must have partnerships with Horizon Finance Group Car Finance Broker financial institutions too. A transparent broker must notify you of the rates of interest supplied by the financing provider and also their markup too. If you're in talks.